Before the end of the financial year (EOFY) on 30 June in Australia, some people donate to a charity to support a cause close to their hearts. This means they can potentially reduce their taxable income while making a positive impact.

If you have never claimed a charitable donation before, it can be tricky to know where to begin. So let’s break down some frequently asked questions about tax-deductible donations.

What are tax-deductible donations?

Tax-deductible donations are simply donations you can claim a portion of at tax time. For example, if you donate $2 or more to a charity, your donation may be considered tax-deductible by the Australian Taxation Office (ATO).

How do tax-deductible donations work?

In Australia, when you donate money to certain charities or funds, you can claim some of that money back when you submit your tax return. But there are rules about what donations you can claim:

- The group or fund you give to has to be approved by the ATO as a Deductible Gift Recipient (DGR). Many charities will provide you with a receipt to prove you donated to them, however, you may have to contact them for one directly.

- If you gave over $2 or more, you can claim a deduction and reduce your taxable income. Remember to keep all your donation records safe so you can claim your donation at tax time.

How much of my donation can I claim?

In Australia, you can claim the full amount of your donation given to a DGR, provided that the donation meets the necessary criteria for deductibility.

According to the ATO, there's no limit to the donations you can claim in a financial year. However, you can't claim a deduction if you received a personal benefit or something in return, except for token items that have immaterial value relative to the size of the donation.

Also, if your charity donations exceed your assessable income in the financial year, you might need to spread the deduction over several years instead.

You can calculate how much of your donation you can claim at tax time with our handy tax-deductible donations calculator below.

Tax donation calculator |

This table is based upon 2024-2025 ATO individual income tax rates. The above rates do not include the Medicare Levy of 2%. The exact level of your tax deductibility will vary depending on your present financial circumstances. Please seek assistance from an independent taxation professional for formal guidelines.

Head to our tax-deductible donations calculator page to find out how your donation can help UNICEF reach children around the world before, during, and after emergencies.

How do I donate to charities?

There are many ways you can support charities like UNICEF Australia and make a positive difference. To find charities registered by the Australian Government, you can use the Government charity register search tool.

UNICEF Australia is registered and acknowledged by the Australian Taxation Office as a DGR, ensuring that all donations of $2 or more to UNICEF Australia are tax-deductible.

From a one-off gift to a fundraising event, there are so many ways you can donate to UNICEF Australia.

How do I claim a tax deduction on my charitable donation?

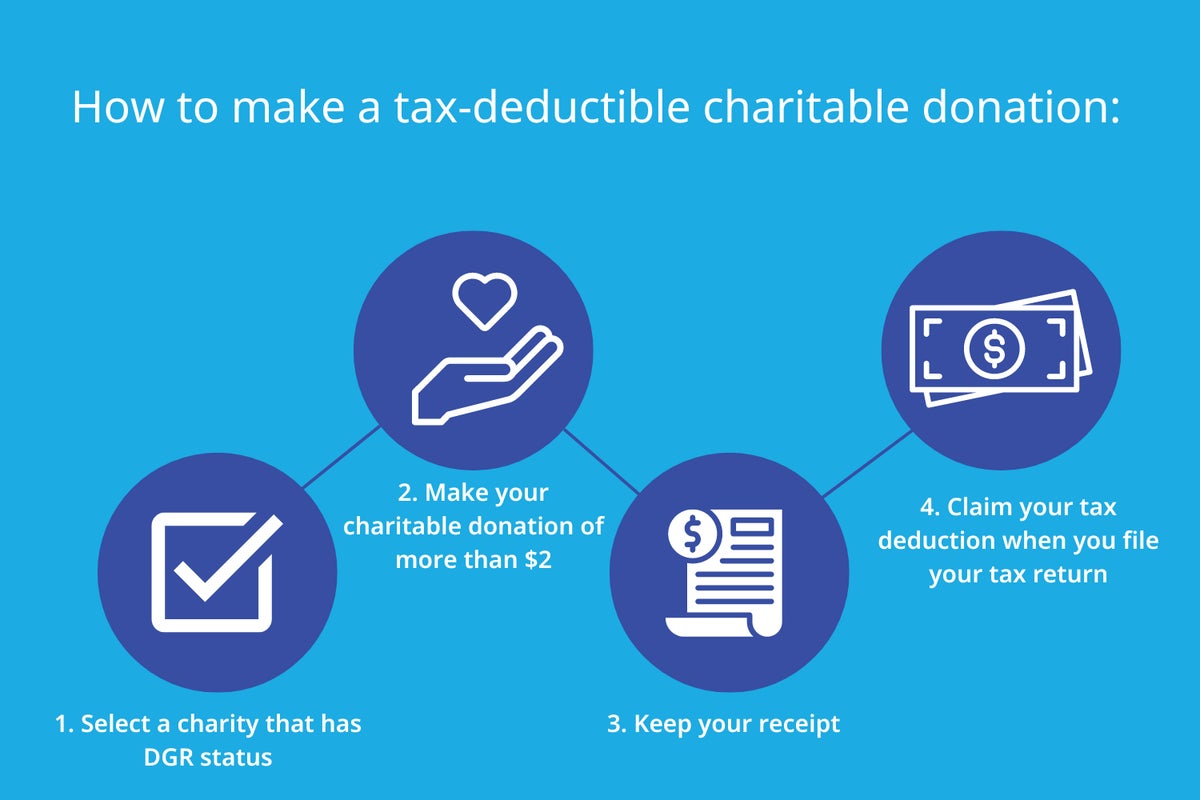

Claiming a tax-deductible donation in Australia is simple. All you have to do is:

- Select a charity or fund that is approved by the ATO.

- Make a donation of more than $2 to your selected charity.

- Keep a record of your receipt stating how much you donated.

- When it's time to do your taxes, you can use that receipt to lower the amount of tax you owe. When you're filling out your tax return, there will be a section where you can enter your deductions, including your charitable donations.

If you are earning more money this year and have been placed in a higher tax bracket, consider donating to a charity to lower your taxable income.

For more information about claiming donations, visit the ATO website.

What are the tax benefits for charitable donations for businesses?

Businesses can claim tax deductions for various tax deductible gifts made to eligible charities, such as one-off donations, regular monthly donations, donations supporting specific appeals, corporate sponsorships, and gifts such as money, property, or shares. Charitable donations are a great way for companies to reduce their taxable income while also giving back to communities in a meaningful way.

You can find more information about claiming tax-deductible charitable donations for businesses on the ATO website.

Why should I give my tax-deductible donation to UNICEF Australia at the end of this financial year?

UNICEF is one of the world's largest children's charities, working to protect and improve the lives of vulnerable children in over 190 countries. From emergency relief to long-term development solutions, UNICEF is 100 percent donor-funded.

Every day, we are working to ensure children are vaccinated, educated, and protected, and we advocate for the rights of every child while helping to elevate their voices. When an emergency strikes, UNICEF acts quickly, delivering lifesaving help to children and families in just 48 hours. Once a crisis ends, UNICEF and our partners remain on the ground helping communities rebuild and recover.

UNICEF will always be there for children before, during, and after emergencies, but we need the help of generous donors like you to reach every child. Please consider making a tax-deductible donation to UNICEF Australia before 30 June.

Donate to UNICEF Australia

Protect the rights and wellbeing of every child by donating to UNICEF Australia today.

Disclaimer: The information on this page is general in nature and is not professional advice. You should consider seeking independent legal, financial or taxation advice about your individual circumstances. UNICEF Australia is not liable for any loss caused arising from the reliance on this information.

Subscribe and stay connected

Get the latest updates, inspiring stories, and ways to get involved, delivered straight to your inbox.

When you subscribe to UNICEF Australia’s email, you’ll learn how we’re making a difference in the lives of children, here in the Asia Pacific and around the world. From emergency relief to long-term development programs, UNICEF is there for every child when they need it most.