Become a UNICEF Australia Workplace Giver, where every donation, big or small, helps change the lives of children around the world.

UNICEF Australia’s workplace giving program offers a simple yet powerful way for you to make a difference in the lives of children in need. By making regular pre-tax donations through your employer’s payroll, you can contribute to our vital work and help change lives, especially in times of crisis.

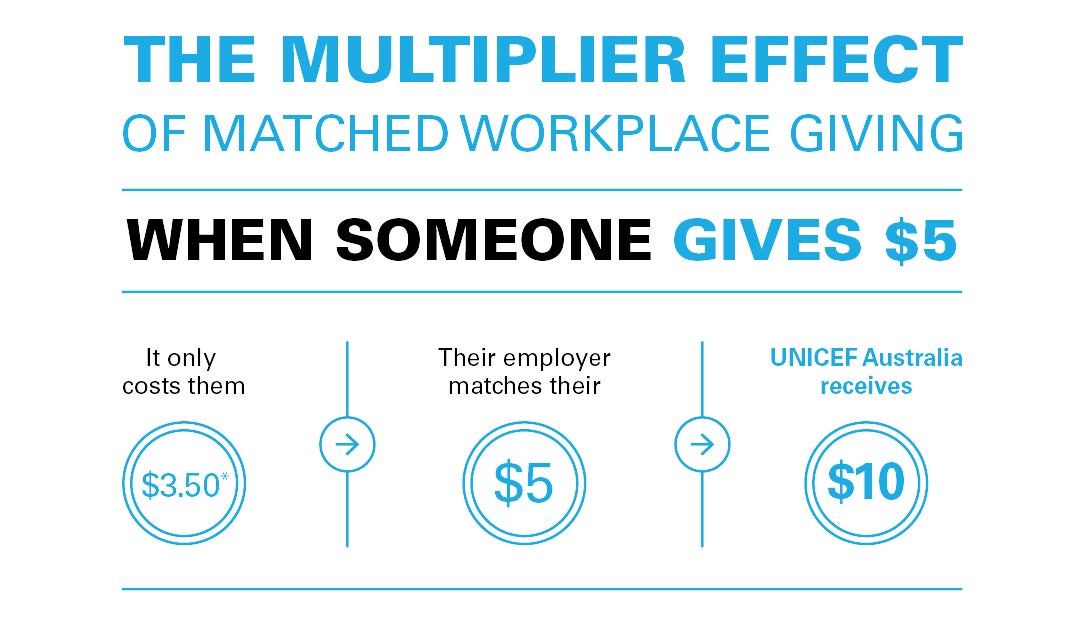

With the flexibility to choose your donation amount, giving has never been easier. Plus, contributions are automatically deducted pre-tax, maximising the impact of your support. Often, donations are matched by employers, doubling or even tripling our impact.

Join us in advocating for the rights of every child and amplifying the voices of young people. Your participation in our workplace giving program can truly make a world of difference.

Double your impact

Workplace giving is not just about individual contributions; it’s also about fostering a culture of collective impact. Employers can match their employee donations dollar for dollar or with another nominated amount. This demonstrates your company’s commitment to making a difference in the lives of children in need.

How your workplace giving donation helps UNICEF Australia

$35

a month could provide 62 sachets of therapeutic food to help a child start their recovery from severe acute malnutrition.

$40

a month could provide exercise books and pencils for 20 children, so they can continue their education.

$50

a month could contribute to psychosocial support for children traumatised by conflict.

What are the tax benefits of being a Workplace Giver for employees?

Workplace giving allows you to support charities that are meaningful to you while receiving an immediate tax benefit instead of waiting until the end of the financial year.

- It’s all organised by your payroll, so there is no upkeep or administration on your behalf.

- It eliminates the need to collect receipts and wait until the end of the financial year to claim tax back.

- Your donation is pre-tax, so it will cost you less than the amount we receive from your organisation. Your employer may also match your contribution.

- Regular giving makes planning easier so we can make the most of every dollar we receive to help ensure that the world’s children are fed, vaccinated, educated, and protected.

Join UNICEF Australia’s Workplace Giving program

To start your workplace giving journey, please reach out to your company’s HR team or contact us for more information.

UNICEF Australia’s Workplace Giving FAQS

Workplace Giving Australia explains that workplace giving is a joint relationship between employers, employees and not-for-profits. Individuals contribute a portion of their pre-tax salary to not-for-profits and receive the tax benefit straight away. Employers often match employee contributions to help make an even bigger impact.

- Employers enjoy greater staff engagement, retention, productivity, reputation and social impact

- Develop leadership, reputation and profile within the community

- Be seen as an employer of choice and increase appeal to new employees

Choosing to become a UNICEF Australia Workplace Giver means you will play a direct hand in creating a brighter future for every child in need. Read ‘Five things UNICEF did for children in 2023’ to learn more!

We rely solely on charitable donations to fund our vital work protecting children, transforming their lives and building a safer world for tomorrow’s children. Workplace Givers help us forecast funds and plan our resources for where they are needed most. That way, you can feel confident knowing your hard-earned money is well-spent.

UNICEF is 100 per cent donor funded and has helped save more lives than any other children’s humanitarian organisation. Thanks to our supporters, we’ve been able to contribute funds to programs in our region, as well as emergencies when they strike. To learn more, head to How your money is used.

$35 a month could provide 62 sachets of therapeutic food to help a child start their recovery from severe acute malnutrition.

$40 a month could provide exercise books and pencils for 20 children, so they can continue their education.

$50 a month could contribute to psychosocial support for children traumatised by conflict.

We have a selection of volunteering opportunities you can participate in through workplace giving. Send us a message at workplacegivers@unicef.org.au to find out more.

UNICEF Australia is listed as a Deductible Gift Recipient (DGR) in Australia. This means that donations over $2 made through UNICEF's Workplace Giving program are eligible for tax deductions.